Do you feel supported and valued by your accountant? They may be keeping your books and your tax returns up-to-date, but are they genuinely interested in your business goals and future plans? Do they keep on top of changes in your sector or advise you on the business support you may be entitled to?

Continue reading Is your accountant doing enough for you and your business?

Tag: vat

5 reasons you should make tax digital…

Time to sack the spreadsheet?

Digital influences almost everything that we do, on a daily basis. Technology and innovation have made life easier and more convenient, enabling tasks to be completed faster and more accurately.

Continue reading 5 reasons you should make tax digital…

What happens if I can’t pay my VAT bill on time?

We can all wax lyrical about the need to budget for VAT and not treat the VAT we collect as our own, but sometimes business isn’t that straightforward. Things happen and, on occasions, it simply might not be possible to pay across the VAT when it falls due, which is normally the 10th working day of the month after the return is submitted…

Continue reading What happens if I can’t pay my VAT bill on time?

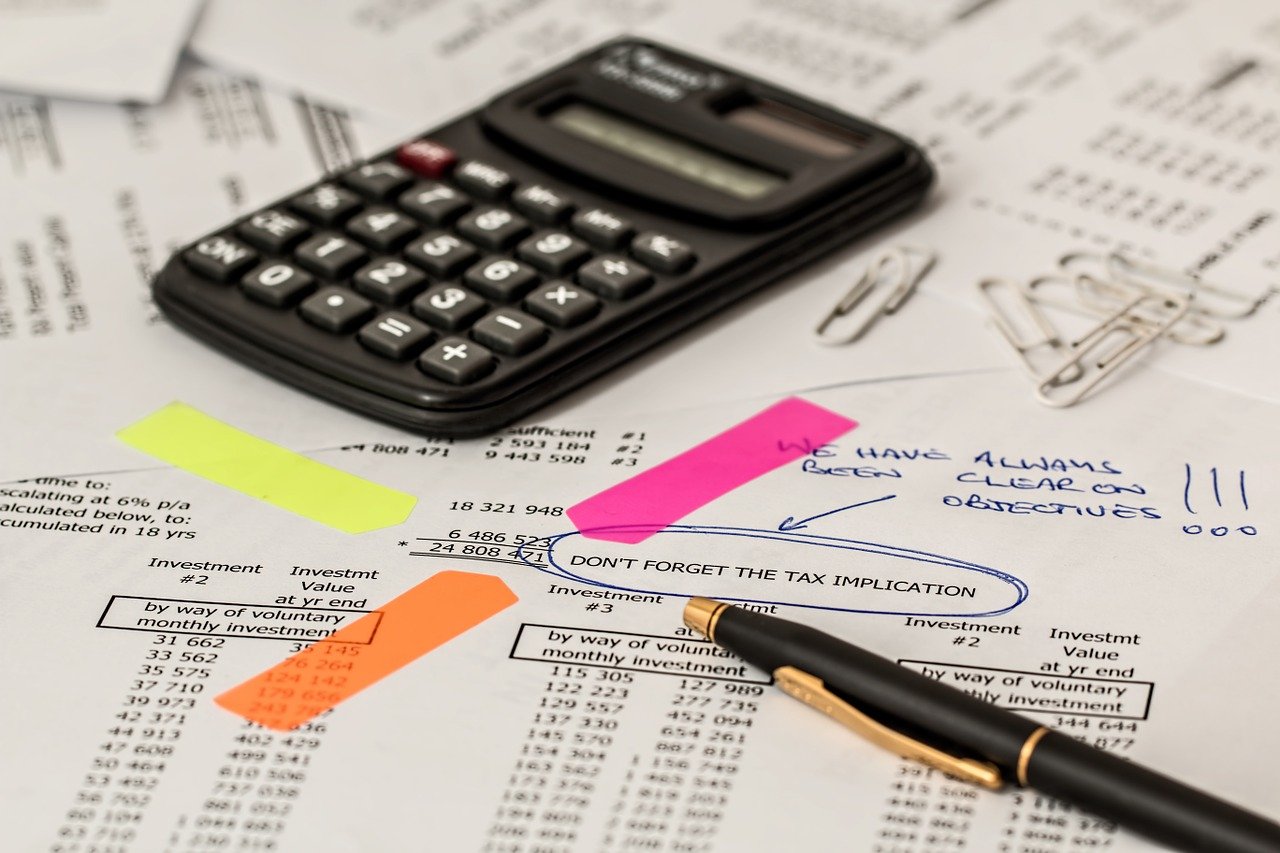

Tax-saving ideas for small business owners…

If you want to stay on the right side of HMRC, which we strongly advise, as a small business owner or sole trader you have to pay tax. However, there is no reason to pay more tax than you need to. You can do various things to minimise your tax bill but, if you run a profitable business, there will always be tax to pay. And though tax avoidance is smart business practice, tax evasion is a crime and knowing the difference is important.

Continue reading Tax-saving ideas for small business owners…

Act Now To Keep HMRC Off Your Back

Most of us who are required to submit a tax return will be well aware of the impending due date of 31st January getting closer and closer. A mandatory £100 fine is given to all those who fail to meet it as soon as you cross midnight on 31st January, and further delays and the penalties can increase up to £1600.