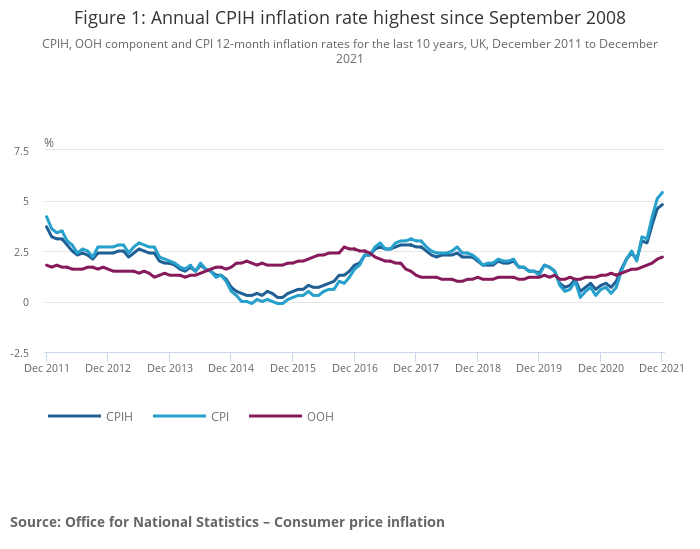

The Consumer Prices Index (CPI) rose by 5.4% in the 12 months to December 2021, its highest level for a decade, and will go higher still as we head into 2022. For pandemic-pressed businesses, the inflation reality is far worse. Their input costs are soaring by unprecedented double-digit figures, while labour rates are rapidly being pushed higher by shortages right across the UK economy.

The question for businesses is how to deal with a 40% rise in construction material costs or a 30% increase in agency rates for truck drivers. What can even the canniest entrepreneur do when the cost of shipping a container of coffee is higher than the sales value of its entire contents? The answer is to look at each element of the profit and loss profile for ways to limit the damage.

Raising prices

If only life was so simple. There are precious few supply chains with totally price-flexible end users, so while there may be some wiggle room to increase prices, the truth is that with such severe input inflation the scope for recovering the higher costs may be limited.

The speed at which costs have risen is as much of a problem as the scale. Taking the softer option of hiking prices gradually to ease the pain and resistance of customers will still leave businesses with damaged margins in the short term.

Eliminating low margin business

With margins under this sort of pressure, there will be some customers and products or services that are longer be viable. There have always been businesses that were busy fools because of their pursuit of growth; now they risk becoming busy loss makers and potential failures. However painful it may be, the sensible strategy is to turn away low margin sales and to stop selling low margin goods or providing services that contribute little to overheads and profits.

Cutting direct costs

It may be possible to renegotiate prices from suppliers, perhaps through bulk buying or faster payments if cash flow permits. It could be that an alternative supply source will be cheaper. This is worth exploring, even if the likely outcome may prove disappointing.

Cutting fixed costs

This is another obvious solution, but one that can be fiendishly difficult to get right, especially when almost two years of pandemic disruption will already have forced many businesses to cut overheads to the bone. Nevertheless, if gross margins are falling, indirect costs must come down too.

It is vital to avoid across the board cost cutting. Every item needs to be reviewed in the context of its contribution and importance to the company’s core strategy and future prospects. If expenditure can be cut without imperilling those aspects, that is good. If not, then leave well alone.

One important step is to ask what exactly the business is spending and why. It can be surprising how little visibility management sometimes has of overheads. Another key question is who within the organisation is incurring costs and then to make them a part of designing and implementing reduction programmes, rather than just imposing them from above.

Retaining the work force

It has never been more important to show employees that they are valued. Losing staff is disruptive and they are both expensive and difficult to replace. Competition for staff has rarely been higher, so there can be significant net gains from some carefully designed pampering with bonuses, pay rises and extra benefits.

Outsourcing

Could some operational or administrative functions be carried out by outside specialist at a lower cost? Any savings will need to be weighed against the inherent risk of losing control of those functions. The financial viability of any potential outsourcer must be checked out carefully beforehand.

Automation

With labour costs rising and staff shortages endemic across the economy, this could be the catalyst to introduce or increase robotics for manufacturing and assembly processes and bring artificial intelligence solutions into back-office operations. Recent research by the Resolution Foundation found that almost 600,000 people have left the UK labour force since the start of the pandemic in what economists are calling “The Great Retirement”. This comes on top of the departure of an estimated 1m+ people following Brexit. Labour scarcity is here to stay.

Investment

The UK already has a poor investment and productivity profile compared to many other leading economies. Giving in to the temptation to slash investment as profits are shrunk by inflation will only compound this. As with overheads, capex plans should be sifted through carefully to avoid throwing the future baby out with the present cash savings. Without investment, businesses do not just stop growing, they stagnate, wither and eventually, they die.

The reality of inflation

Few enterprises come out of a sharp and sudden rise in inflation without seeing profits fall, at least in the short term. The tactics described here should limit the damage but preserve future prospects when markets have adjusted to new cost and price levels.

Taking expert advice

Many of the decisions needed to implement these tactics will be counter-intuitive and stressful for managers and owners, who have already endured the most traumatic eighteen months in living memory. Being suitably selective and objective takes a miracle under such trying circumstances. Getting help from independent advisers, who have experience of these situations and are not distracted by emotional attachment to the business and its stakeholders would be a positive step.

If you are affected by any of these issues, Opus is here to help. Please contact our Partner Adrian Dante at our Maidstone Office . Opus ethos has always been to engage with those facing difficulties with a constructive and positive attitude.