The covid loan schemes

The government’s speedy launch of the various Coronavirus Business Support loan schemes when the pandemic struck in 2020 was one of the most important planks in the raft of measures intended to prevent viable businesses from failing as Covid ravaged the UK economy. By May 2021 when the schemes closed to new applications, a total of some £80bn had been lent to 1.67m businesses.

Continue reading Covid loans: An escalating crisis…

Category: Uncategorized

The new phase of the Recovery Loan Scheme – Key changes for businesses…

The Recovery Loan Scheme, first introduced by the British Business Bank in 2021 and the successor to the Coronavirus Business Interruption Loan Scheme (CBILS), was created as a measure and means to support businesses by providing access to finance as they recover and grow following the pandemic…

Continue reading The new phase of the Recovery Loan Scheme – Key changes for businesses…

HMRC petitions and debt recovery: What directors need to know…

Business owners are facing a deluge of financial and operational pressures at the moment. From inflation to supply chain disruption and labour shortages, finding a solid financial footing is immensely challenging right now. Added to this is the increased call in of debts following the removal of prohibitions on Winding Up Petitions for creditors, including HMRC.

Continue reading HMRC petitions and debt recovery: What directors need to know…

What does HMRC having ‘recovery powers’ mean for Directors?

While company directors are generally protected by limited liability, recovery powers granted to HMRC in the Finance Act 2020 mean directors can face greater personal liability for tax debts held by the company in the event of insolvency…

Continue reading What does HMRC having ‘recovery powers’ mean for Directors?

What can unincorporated businesses do when struggling with debt?

The Bank of England’s latest interest rate hike to 1.25% in June might not take us anywhere near the terrifying heights of 17% seen back in 1979, but for many it may turn out to be the final financial straw. Compounded as it is by a cost of living crisis where inflation has already hit a 40-year high of 9.1% and is expected to go into double figures later this year, the economic situation is grim…

Continue reading What can unincorporated businesses do when struggling with debt?

Why Train in First Aid?

We all hear about it, but What is First Aid? It is simply basic medical treatment that is given to someone as soon as possible after they have been hurt in an accident or suddenly become ill…

Continue reading Why Train in First Aid?

Insolvency guidance for directors if your company is in distress…

As the Spring flowers continue to bloom and hopefully the heat of summer is not far off, conversely we are witness to numerous chilling pressures being brought to bear on directors as they navigate through these challenging economic times. When we factor in worryingly persistent inflation, an emerging trend of rising interest rates, supply chain disruption, staffing issues, energy costs, an increasing tax burden, growing wage pressure and the consequences of the war in Ukraine, the landscape looks decidedly bleak…

Continue reading Insolvency guidance for directors if your company is in distress…

Closing your company: Strike off versus Voluntary Liquidation

The impact of the last two years

It goes without saying that many thousands of Companies have struggled since the beginning of the Covid crisis. Many of those Companies would have utilised the various schemes and assistance put in place by the government, banks and HMRC.

Continue reading Closing your company: Strike off versus Voluntary Liquidation

Concerned about Bounce Back Loan Repayment and Furlough Fraud?

When the government was giving out Coronavirus business support in 2020 like free sweets in Santa’s Grotto – most businesses were both grateful and relieved. Few will have given much thought to the future at a time of such crisis and deep uncertainty…

Continue reading Concerned about Bounce Back Loan Repayment and Furlough Fraud?

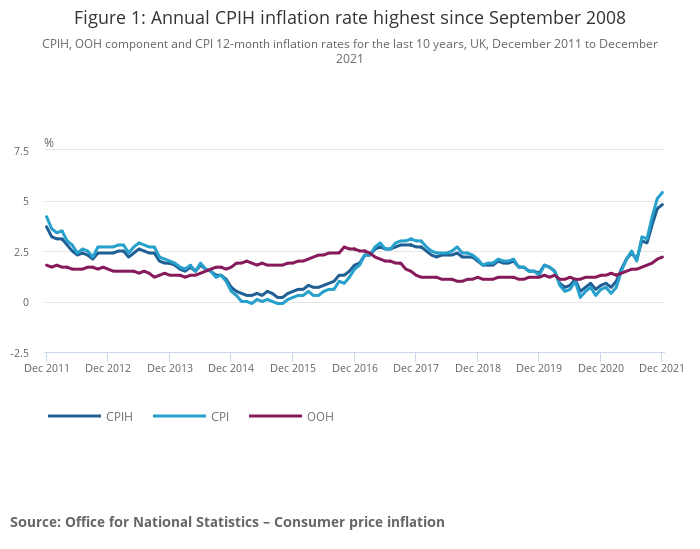

Living with rising costs in an inflationary world…

The Consumer Prices Index (CPI) rose by 5.4% in the 12 months to December 2021, its highest level for a decade, and will go higher still as we head into 2022. For pandemic-pressed businesses, the inflation reality is far worse. Their input costs are soaring by unprecedented double-digit figures, while labour rates are rapidly being pushed higher by shortages right across the UK economy.

Continue reading Living with rising costs in an inflationary world…