Image courtesy of Living Wage Foundation

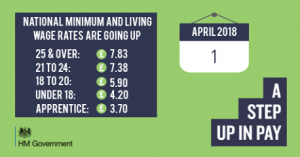

National Minimum and National Living Wage rate increases on 1 April.

The National Minimum Wage applying to workers aged 21 and over has increased from £7.05 to £7.38 an hour. But don’t forget if you have staff who are 25 or over they are subject to the National Living Wage, which has increased from £7.50 to £7.83 an hour. For staff who are paid at this level, make sure you track when they reach their 25th birthday, so you can tell them of their increase before they tell you!

Other rates have increased as follows:

Apprentices under 19 or 19 and above in their first year: From £3.50 to £3.70

Young workers under 18: From £4.05 to £4.20

Development rate 18 – 20: From £5.60 to £5.90

Statutory pay rates (maternity, paternity etc) increases on 1 April

Statutory maternity and other related family leave pay rates increase from £140.98 to £145.18 a week (or 90% of wages in first 6 weeks if more).

Statutory sick pay increases from £89.35 to £92.05 a week.

The maximum statutory redundancy pay rate also increases on 6 April from £489 to £508 a week.

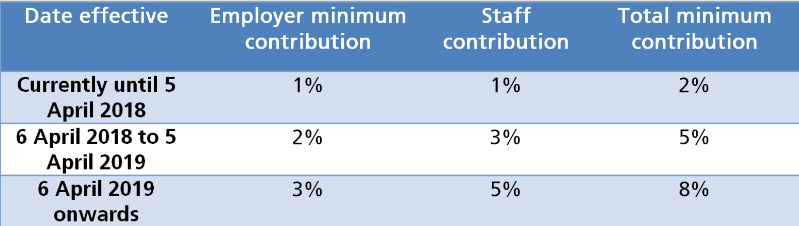

Pensions auto-enrolment contribution rate increases from 6 April

Employer contributions go up from 1% to 2% and employees contribution rates from 1% to 3% (within certain salary range). Therefore most staff will see their net pay reduced at the end of April. Rather than wait for them to find out then, it’s a good idea to make sure they know now. Some employers are putting up wages to compensate for this, yet another cost!

Image Courtesy of BBi Financial Planning

You must not fall foul of the law by failing to make the changes.

But if these extra costs are putting pressure on your business and you are having to think about savings, talk to The HR Dept. We can advise you if you are considering restructuring or reorganising, changing terms of employment or even downsizing.

simon.morgan@hrdept.co.uk 0345 634 9154